- Military personnel under contract of the Armed Forces of Ukraine; personnel of the Security Service of Ukraine; the Foreign Intelligence Service of Ukraine; the Main Intelligence Directorate of the Ministry of Defence of Ukraine; the National Guard of Ukraine; the State Border Guard Service of Ukraine; the State Protection Department of Ukraine; the State Service of Special Communications and Information Protection of Ukraine; the State Special Transport Service of Ukraine; prosecutors of specialised prosecution offices in the field of defence of the Office of the Prosecutor General; employees of the State Emergency Service of Ukraine; personnel of the Judicial Security Service of Ukraine; senior officers of the Special Operations Directorate of the National Anti-Corruption Bureau of Ukraine; detectives and senior detectives of the National Anti-Corruption Bureau of Ukraine; rank-and-file and senior officers of the State Bureau of Investigation; detectives and senior officers of the Bureau of Economic Security of Ukraine; servicemen conscripted for military service during mobilisation; police officers and members of their families.

- Medical workers – specialists and professionals of healthcare institutions of state and municipal ownership.

- Teaching staff of educational institutions of state and municipal ownership

- Research and academic teaching staff of educational institutions and research institutions of state or municipal ownership.

- War veterans and members of their families; combatants; persons with disabilities as a result of the war; families of deceased (fallen) war veterans as defined by Article 10 of the Law of Ukraine “On the Status of War Veterans, Guarantees of Their Social Protection”; as well as families of deceased (fallen) Defenders of Ukraine.

- Internally displaced persons.

- Other citizens who do not own housing, or whose total housing area is less than 52.5 m² for a household of one or two persons, plus an additional 21 m² for each subsequent family member.

-

citizens of Ukraine;

-

aged from 18 years as of the date of loan origination to 70 years as of the loan maturity date;

-

solvent;

-

do not own residential real estate, or the total area of such real estate does not exceed 52.5 m² for a household of one or two persons, plus an additional 21 m² for each subsequent family member;

-

have not disposed of residential real estate within the past 36 months, or the total area of the disposed property together with the area of existing housing does not exceed 52.5 m² for a household of one or two persons, plus an additional 21 m² for each subsequent family member;

-

are not subject to sanctions and are not included in sanctions lists.

* Residential real estate located in areas of active hostilities or in territories under temporary occupation, as well as destroyed property, is not taken into account.

* The list of partner banks under the programme will be expanded.

-

an apartment or property rights to an apartment in a multi-apartment residential building, or a residential house;

-

floor area:

-

apartment — not more than 52.5 m² for a household of one or two persons, plus 21 m² for each subsequent family member, but not more than 115.5 m² regardless of the number of family members;

-

residential house — not more than 62.5 m² for a household of one or two persons, plus 21 m² for each subsequent family member, but not more than 125.5 m² regardless of the number of family members;

-

-

located within the territory of Ukraine, except for temporarily occupied territories and areas of active hostilities;

-

for servicemen and security personnel, medical workers, teachers, researchers, and veterans:

a private house or an apartment in a building under construction or in a building not older than 20 years in Chernihiv, Sumy, Kharkiv, Zaporizhzhia, and Kherson Oblasts; in other oblasts — not older than 3 years; -

for internally displaced persons (IDPs) — housing not older than 20 years in all regions where the programme is implemented;

-

for other categories — a private house or an apartment in a building under construction or not older than 3 years;

-

housing that has been commissioned must be subject to mandatory insurance;

-

residential real estate classified as architectural heritage sites may not be used as collateral under a mortgage.

-

the maximum price per 1 m² of housing or property rights to housing may not exceed twice the indicative cost of housing by region of Ukraine as determined by the Ministry for Development;

-

the actual price per 1 m² of housing or property rights to housing may not exceed the maximum price by more than 10 percent;

-

the actual floor area of housing up to 3 years old or of property rights to housing may not exceed the standard floor area by more than 10 percent; exceeding the actual floor area for housing older than 3 years is not permitted;

-

the actual total cost of housing may not exceed the standard values by more than 10 percent;

-

any permissible excess shall be paid by the borrower using their own funds.

After reviewing the terms of the programme, Oleksandr decided to purchase an apartment for his family in Vinnytsia. Oleksandr lives with his wife; therefore, the standard floor area for their household is 52.5 m².

He found an apartment in a residential building commissioned in 2025. He calculated the standard cost of the housing as follows: he identified the indicative cost of housing by region of Ukraine as determined by the Ministry for Restoration for Vinnytsia Oblast and multiplied it by a coefficient of 2. Thus, the standard cost per 1 m² of his housing amounts to UAH 49,638.

| Total cost of the housing (52.5 m² × UAH 49,638) | UAH 2,605,995 |

| Down payment (20% of the total cost) | UAH 521,199 |

| Additional loan-related costs | UAH 68,922 |

| Monthly payment (taking into account an annual interest rate of 3%) | UAH 11,570 |

| Loan origination fee, one-time, 1% of the loan amoun | UAH 20,848 |

| Mandatory state pension insurance contribution, one-time, 1% of the housing cost | UAH 26,059 |

| Insurance of real estate (mortgage collateral), annually, 0.25% of the housing cost | UAH 6,515 |

| Appraiser’s services, one-time (estimated) | UAH 3,500 |

| Notary services, one-time (estimated) | UAH 12,000 |

* vary depending on the banks

2

Receive offers from banks, choose one

3

Find the option you plan to purchase, provide the bank with the necessary documents

4

Undergo data and document verification at the selected bank

5

Sign a contract with the bank and a purchase agreement for the chosen apartment

If you have received a housing Certificate under the yeVidnovlennia programme in accordance with Resolution of the Cabinet of Ministers of Ukraine No. 600 dated 30 May 2023, and you wish to purchase housing the value of which exceeds the value of the Certificate, this Certificate may be used as a down payment under the yeOselia programme, with the remaining amount to be financed through a loan.

To do so, the following steps must be completed:

FOR WHOM: Internally displaced persons and persons registered in areas of hostilities who:

- do not own housing (housing located in territories where hostilities are ongoing or were conducted, or in temporarily occupied territories, is not taken into account in accordance with the interpretation of the order of the Ministry for Communities and Territories Development of Ukraine);

- have not disposed of housing within the past 36 months.

- 70% of the down payment, provided that it does not exceed 30% of the property value;

- 70% of monthly loan and interest payments during the first year, but not more than UAH 150,000;

- up to UAH 40,000 to cover transaction (contract execution) costs.

1. Submit an application for a loan under the yeOselia program via the Diia app;

2. After receiving preliminary approval, choose a bank;

3. Submit an application for state assistance to the selected bank;

4. Based on the application, the bank obtains confirmation from the Pension Fund of Ukraine that the applicant meets the requirements of Resolution No. 998;

5. If eligibility is confirmed, submit the full set of documents to the bank for a final lending decision;

6. After approval, pay 30% of the down payment; the bank will inform you about the transfer of the state assistance and the date for signing the agreements;

7. Sign the purchase and sale agreement and the relevant agreements with the bank.

| Category No. | Borrower category | Loan interest rate, % | Where the housing is purchased | Age of the housing | Housing price |

| 1 – 4 | Preferential categories:

– Military personnel and security sector workers;– Medical workers; – Educators; – Researchers. |

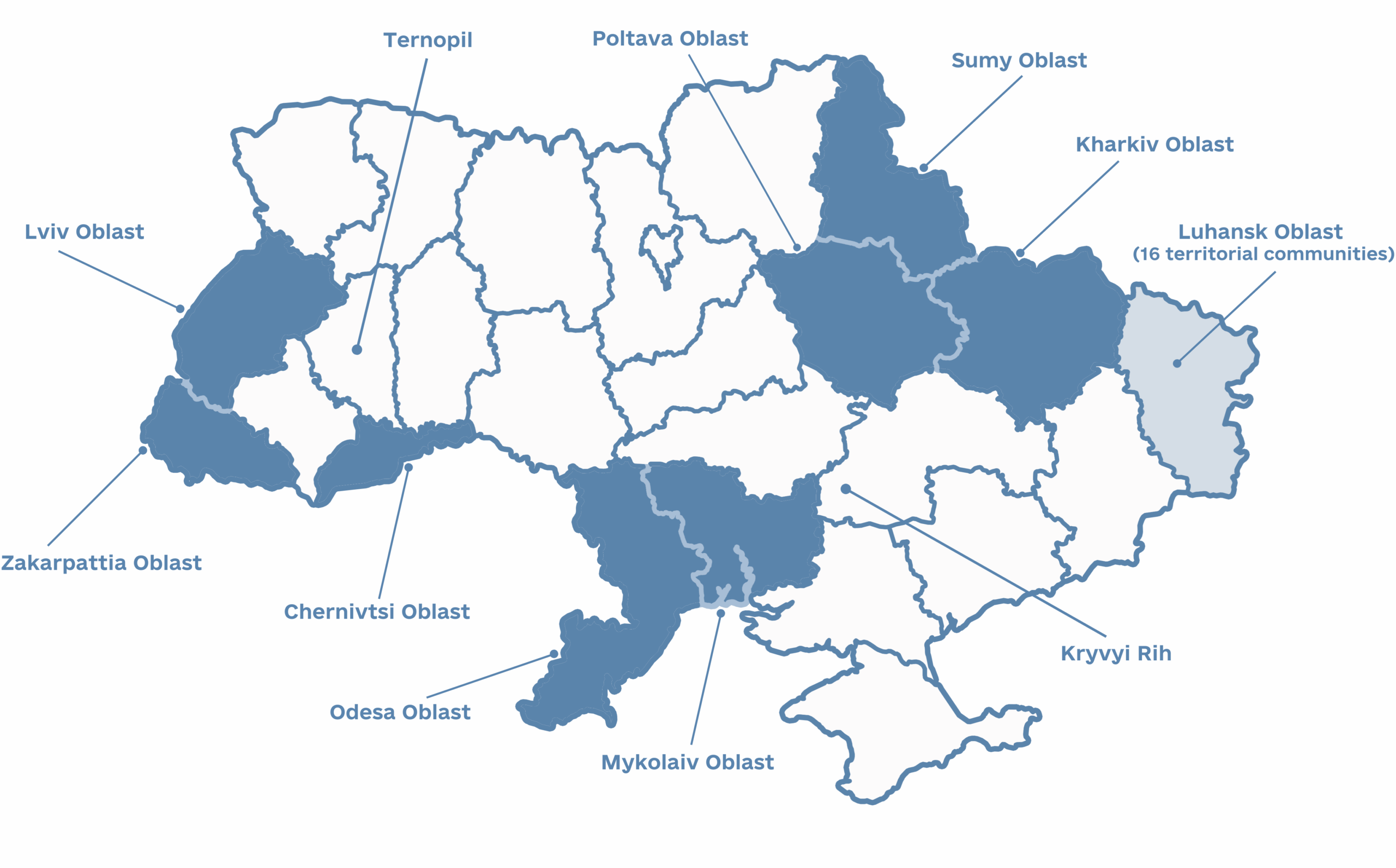

3% | settlements of Chernihiv, Zaporizhzhia, Kherson, Kharkiv, and Sumy regions | up to 20 years | Up to UAH 2 million |

| settlements of regions except Chernihiv, Zaporizhzhia, Kherson, Kharkiv, and Sumy | up to 3 years | ||||

| 5 | Veterans | 7% | settlements of Chernihiv, Zaporizhzhia, Kherson, Kharkiv, and Sumy regions | up to 20 years | |

| settlements of regions except Chernihiv, Zaporizhzhia, Kherson, Kharkiv, and Sumy | up to 3 years | ||||

| 6 | IDPs | 7% | Any settlement in the government-controlled territory of Ukraine | up to 20 years | |

| 7 | Other | 7% | Any settlement in the government-controlled territory of Ukraine | up to 3 years |

- 3% annual interest rate compensation

- for contract service members of the Armed Forces of Ukraine, security and defense personnel, war veterans, combatants, persons with war-related disabilities, families of fallen veterans, and internally displaced persons (IDPs)

- 3% annual interest rate compensation

- contract servicemembers of the Armed Forces of Ukraine, mobilized servicemembers, and law enforcement personnel, as well as their family members; war veterans and their family members; combatants; persons with disabilities resulting from the war; and families of fallen (deceased) war veterans and defenders

- 3% annual interest rate compensation

- for contract service members of the Armed Forces of Ukraine and security personnel

- 3% annual interest rate compensation

- for contract service members of the Armed Forces of Ukraine, war veterans, combatants, and persons with war-related disabilities

- 3% annual interest rate compensation

- for veterans

- 3% and 6% annual interest rate compensation

- 3% for contract service members of the Armed Forces of Ukraine, and 6% for veterans

- 3% annual interest rate compensation

- contracted servicemembers of the Armed Forces of Ukraine and law enforcement personnel, as well as their family members; war veterans and their family members; combatants; persons with disabilities resulting from the war; families of fallen (deceased) war veterans and defenders; and internally displaced persons (IDPs)

- partial reimbursement of the down payment

- for servicemen, law enforcement officers, educational and medical workers, researchers, and members of their families in the Mykolaiv City Territorial Community

- 3% annual interest rate compensation

- for contract service members of the Armed Forces of Ukraine and security personnel, medical workers, educators, and researchers

- partial reimbursement of the down payment

- servicemembers of the Armed Forces of Ukraine and law enforcement personnel

Sievierodonetsk UH (urban hromada), Lysychansk UH, Popasna UH, Rubizhne UH, Kreminna UH, Svatove UH, Shchastia UH, Aidar SH, Bilokurakyne SH (settlement hromada), Markivka SH, Bilolutsk SH, Novoaidar SH, Shyrokyne SH, Stanychno-Luhanske SH, Bilovodsk SH, Milove SH.

- partial reimbursement of the down payment

- for internally displaced persons (IDPs) — residents of these communities

Provision of affordable mortgage lending

to citizens of Ukraine by the Private Joint-Stock Company

“Ukrainian Financial Housing Company”

under the “eOselia” programme

As a leading financial institution, Ukrfinzhytlo participates in the implementation of national and international customer identification standards, in particular the requirements of the Law of Ukraine dated 06.12.2019 No. 361-IX ‘On Prevention and Counteraction to Legalisation (Laundering) of Criminal Proceeds, Terrorist Financing and Financing of Proliferation of Weapons of Mass Destruction’ (as amended), the Regulation on Financial Monitoring by Institutions, approved by Resolution of the Board of the National Bank of Ukraine No. 107 dated 28.07.2020 (as amended). In order to establish (continue) business relations, please answer the questions of this Questionnaire and send it to info@ukrfinzhytlo.in.ua by signing the QES.

Instructions for signing are available here

You can apply for the program through the Diia mobile app in the “Services” section.

To submit your application, follow these steps:

1. Go to “Services” and select yeOselia.

2. Fill in information about your family composition.

3. Enter your spouse’s identification number and your family’s average monthly income.

4. Provide details about the property you plan to purchase with a mortgage.

5. Choose a bank and sign the application with your qualified electronic signature (QES).

6. Receive a response from the bank.

A message from the bank with a preliminary offer for affordable mortgage lending will be sent to the Diia app within 24 hours.

According to the Resolution of the Cabinet of Ministers of Ukraine No. 856 dated August 2, 2022, Ukrainian citizens who belong to one of the following categories can participate in the program:

- Military personnel serving under contract in the Armed Forces of Ukraine, the Security Service (SBU), the Foreign Intelligence Service, the Main Intelligence Directorate of the Ministry of Defense, the National Guard, the State Border Guard Service, the State Protection Directorate, the State Service of Special Communications, the State Special Transport Service, prosecutors of specialized defense prosecution offices of the Prosecutor General’s Office, officers and rank-and-file staff of the State Emergency Service, employees of the Court Security Service, detectives and senior detectives of the National Anti-Corruption Bureau, officers and rank-and-file staff of the State Bureau of Investigation, detectives and officers of the Bureau of Economic Security, and police officers — as well as their family members. Individuals who were dismissed from these positions or lost their status due to receiving disability group I or II as a result of the war, after obtaining a yeOselia mortgage, are also included in this preferential category for the duration of their disability. However, their family members are not included.

- Healthcare professionals, according to the Order of the Ministry of Health of Ukraine dated March 29, 2002, No. 117 “Directory of Qualification Characteristics of Employees’ Professions. Issue 78: Healthcare” (Alphabetical Index of Professions – sections “Professionals” and “Specialists”).

- Teaching staff of educational institutions of state or communal ownership, according to the Resolution of the Cabinet of Ministers of Ukraine No. 963 dated June 14, 2000, “On Approval of the List of Positions of Teaching and Scientific-Pedagogical Workers” (section “Positions of Teaching Staff”).

- Scientific and scientific-pedagogical workers of educational and research institutions of state or communal ownership, in accordance with Article 31 of the Law of Ukraine “On Scientific and Scientific-Technical Activities”, and the same Resolution No. 963 (section “Positions of Scientific and Scientific-Pedagogical Workers of Higher Education Institutions of Levels III–IV of Accreditation”).

You may choose an apartment or a private house. The housing must meet the following requirements:

1. Location of the property

The residential property must be located within the territory of Ukraine (except for residential properties located in areas of active hostilities, areas of active hostilities where state electronic information resources are functioning, or territories of Ukraine temporarily occupied by the Russian Federation, which are included in the list of territories where hostilities are ongoing or were conducted, or which are temporarily occupied by the Russian Federation, approved by the Ministry for Development, for which the date of completion of hostilities or temporary occupation has not been determined).

2. Standard floor area of housing

-

for an apartment in a multi-apartment residential building:

not more than 52.5 m² for a household of one or two persons, plus 21 m² for each subsequent family member, but not more than 115 m²; -

for a private house or a townhouse:

not more than 62.5 m² for a household of one or two persons, plus 21 m² for each subsequent family member, but not more than 125.5 m².

3. Requirements regarding the “age” of housing

For servicemen of the Armed Forces of Ukraine, teachers, medical workers, researchers, and war veterans:

-

if the real estate property (apartment, house, or townhouse) is located in Chernihiv, Sumy, Kharkiv, Zaporizhzhia, or Kherson Oblasts, it must have been commissioned no earlier than 20 years prior to the date of conclusion of the agreement;

-

if the real estate property is located in other oblasts or in the city of Kyiv, it must have been commissioned no earlier than 3 years prior to the date of conclusion of the agreement.

For internally displaced persons (IDPs):

-

the real estate property must have been commissioned no earlier than 20 years prior to the date of conclusion of the agreement in all regions where the programme is implemented.

For other categories of borrowers:

-

the real estate property must have been commissioned no earlier than 3 years prior to the date of conclusion of the agreement.

Yes, you may, but subject to certain limitations.

The following excesses are permitted:

-

the maximum price per 1 m² — by no more than 10%;

-

the standard floor area of housing up to 3 years old or of property rights to housing — by no more than 10%;

however, exceeding the standard floor area for housing older than 3 years is not permitted; -

the actual total cost of housing may not exceed the standard values by more than 10%.

Any permitted excesses may be paid by you using your own funds.

— household of 1 person: 52.5 m²;

— 2 persons (husband and wife or parent and child): 52.5 m²;

— 3 persons (husband, wife, and child): 52.5 + 21 = 73.5 m²;

— 4 persons (husband, wife, and two children): 52.5 + 21 + 21 = 94.5 m²;

— 6 persons (husband, wife, and four children): a maximum of 115.5 m² may be purchased.

Currently, the following banks are integrated into the program:

1. JSC ‘OSCHADBANK’;

2. JSC CB ‘PRIVATBANK’;

3. JSB ‘UKRGASBANK’;

4. JSC CB GLOBUS;

5. JSC ‘SKY BANK’;

6. JSC ‘SENSE BANK’

7. JSC ‘BANK CREDIT DNIPRO’

8. JSC ‘TASCOMBANK’

9. JSC ‘BISBANK’

10. JSC ‘RADABANK’

thrhbsh

240 months.

The insurance rate must not exceed:

— 0.25% per year of the property’s value — if the insurance contract does not include additional coverage for damage caused by military actions;

— 1.25% per year of the property’s value — if the insurance contract includes additional coverage for damage caused by military actions.

Yes, it is possible. However, only provided that the total floor area of residential real estate owned by the applicant and members of their family is less than 52.5 m² for a household of one or two persons, plus an additional 21 m² for each subsequent family member. Residential real estate located in areas of military (combat) operations or in territories under temporary occupation, encirclement (blockade) is not taken into account, as determined in accordance with the List of territorial communities located in areas of military (combat) operations or in temporary occupation, encirclement (blockade), approved by Order of the Ministry for Development dated 28 February 2025 No. 376 “On Approval of the List of Territories Where Hostilities Are (Were) Conducted or Temporarily Occupied by the Russian Federation”, taking into account the temporarily occupied territory of the Autonomous Republic of Crimea and the city of Sevastopol.

In addition, if you have disposed of residential real estate within the past 36 months, in order to participate in the programme, the floor area of such disposed property together with the floor area of residential real estate currently owned by the family must not exceed 52.5 m² for a household of one or two persons, plus an additional 21 m² for each subsequent family member.

Yes, you can. The yeOselia program allows you to purchase an apartment in a new building or property rights for an apartment in a building that is still under construction. You can view the list of developers and properties eligible for purchase under the program by following the link.

The loan issuance process includes the following stages:

— submitting an application;

— review of the application by the bank;

— bank decision on lending and provision of a list of required documents to the applicant;

— submission of documents by the borrower, their family members, and guarantor (if applicable), as well as documents related to the mortgage property;

— signing of agreements — including the loan, mortgage, guarantee, and insurance contracts;

— loan disbursement — the borrower receives the credit funds.

Starting from September 19, 2024, and for 10 years from the date the loan agreement is signed, the base interest rate is 7% per annum. However, beginning on the first calendar day of the 11th year of the loan agreement, the rate will be 10% per annum. Interest rate compensation for certain borrower categories will remain in effect — from the first calendar day of the 11th year, compensation will be provided to the level of 6% per annum.

For agreements signed before the changes were introduced, the interest rate remains fixed for the entire duration of the loan. Base interest rate — 7% per annum. Preferential interest rate for specific categories — 3% per annum.

If a borrower belonging to a preferential category changes jobs and loses the right to interest rate compensation, they will continue repaying the loan at the base program rate of 7% per annum.

Example: a healthcare worker employed at a state-owned medical institution received a loan at 3% per annum. Three years later, they moved to work in a private medical facility. Since under the program only medical professionals working in state or municipal institutions are eligible for the preferential rate, they will continue repaying the loan at the base interest rate of 7% per annum.

Yes, you are. According to Article 166 of the Tax Code of Ukraine, a taxpayer has the right to a tax rebate, since one of the expenses allowed for inclusion in the rebate is the reimbursement of part of the interest paid on a mortgage housing loan.

The grounds for calculating the tax rebate, including the exact amounts, must be indicated by the taxpayer in the annual tax declaration, which must be submitted by December 31 of the year following the reporting tax year. The total amount of the tax rebate cannot exceed the taxpayer’s annual taxable income received as wages, reduced in accordance with paragraph 164.6 of Article 164 of the Tax Code of Ukraine.

Please note that the central executive authority responsible for implementing state tax policy provides free consultations on the procedure for confirming eligibility for the tax rebate and filing the tax declaration. This includes conducting training sessions and seminars, as well as providing free declaration forms and other necessary documents upon request. For more detailed information, please contact the State Tax Service at your place of registration.

No, you do not. According to paragraph 15-1 of the Procedure for Payment of the Mandatory State Pension Insurance Fee on Certain Types of Business Transactions, approved by the Resolution of the Cabinet of Ministers of Ukraine No. 1740 dated November 3, 1998 (as amended), individuals who purchase real estate are required to pay a 1% fee of the property value specified in the purchase agreement. However, this does not apply to citizens who are buying a home for the first time or those who are registered in the housing queue for receiving a dwelling.

Yes, you can. These programs are not mutually exclusive.

Moreover, you can use the yeVidnovlennia certificate to pay the down payment (or part of it) under the yeOselia mortgage program.

No, it cannot. According to the Law of Ukraine “On Mortgage”, real estate that may be mortgaged includes land plots and objects permanently attached to the land, the relocation of which is impossible without reducing their value or altering their intended purpose.

Yes, you can. If you belong to a preferential category and hold an active IDP (internally displaced person) certificate, you are eligible for state compensation.

Example: a serviceman of the Armed Forces of Ukraine (or a medical worker, scientist, or teacher) qualifies for a preferential mortgage at 3% per annum. When submitting the application, they indicate their category as military personnel. If they also have a valid IDP certificate, they can apply for the 70% state compensation through the bank chosen for the mortgage.

No, you cannot. Resolution No. 998 came into force on September 10, 2025 — from this date, it became possible to apply for the compensation. Moreover, the approval for compensation from the Pension Fund of Ukraine must be obtained before the loan is issued.

Warning for Borrowers of the e-Housing Program regarding the possible consequences of failure to fulfill obligations under the loan agreement

A borrower who receives a loan under the e-Housing Program is obliged to:

– Pay interest on the loan, commissions and accompanying services, penalties (if any) in accordance with the terms of the mortgage loan (loan agreement/mortgage loan agreements, mortgage agreements/mortgage agreements) and the legislation of Ukraine.

– Repay the loan amount within the established period in accordance with the repayment schedule.

Borrower’s Rights:

– Early repayment of the loan – The borrower has the right to fully or partially repay the loan before the established period without applying penalties.

– Refusal to receive advertising materials – The borrower may refuse advertising sent by means of remote service.

– Obtaining a certificate after the contract is terminated – After the contract expires or is terminated, the Borrower has the right to request an information certificate on the fulfillment of his obligations. Such a certificate is provided in paper or electronic form within five business days after the request.

– If necessary, contact the body that carries out state regulation of financial services markets and has the authority to protect the rights of consumers of financial services. Contact information of the Regulator that carries out state regulation of the Company’s activities: National Bank of Ukraine, 11-b Instytutska St., Kyiv-8, 01601, phone number — 0 800 505 240, e-mail — nbu@bank.gov.ua.

– Obtain information on the financial performance indicators and economic condition, which are subject to mandatory disclosure, of the financial services provider

Borrower’s liability in case of violation of the terms of the agreement:

– For non-fulfillment or improper fulfillment of obligations under the loan agreement/mortgage loan agreement, the Borrower is liable in accordance with the terms of such agreement and the requirements of the legislation of Ukraine.

– In case of failure by the Borrower to fulfill his obligations under the credit agreement/mortgage loan agreement and mortgage agreements/mortgage agreements, as well as in case of loss or significant deterioration of the condition of the property provided as collateral, which remains in the use of the borrower, the Lender (PJSC “UKRFINZHYTLO” or the Bank – an authorized entity), has the right, in cases specified in the credit and mortgage agreements, to demand full early repayment of loan payments of the principal amount of the debt under the loan, accrued interest and, if applicable, penalties

– In case of violation by the Borrower of the terms of the credit agreement/mortgage loan agreement regarding the timely payment of the debt under such credit agreement for more than 90 calendar days, the borrower loses the right to compensation for interest.

– In case of untimely or incomplete fulfillment by the Borrower of obligations under the loan agreement/mortgage loan agreement, the Lender (PJSC “UKRFINZHYTLO” or the Bank – an authorized entity) may demand payment of penalties from the Borrower

– In cases of non-fulfillment and improper fulfillment by the Borrower of its obligations to repay the loan and/or pay interest on the loan, and as a result of the occurrence of overdue debt, the Lender (PJSC “UKRFINZHYTLO” or the Bank – an authorized entity) shall transmit to the credit bureau information on the violation by the Borrower of the terms of the loan agreement, which in the future may lead to refusal to provide a loan by other financial institutions.

Important restrictions:

– Changes to the contract: The lender (PJSC “UKRFINZHYTLO” or the Bank – an authorized entity) does not have the right to make changes to the concluded contract unilaterally, unless otherwise provided for by the contract or legislation.

– Imposition of services: It is prohibited to require the Borrower to purchase any goods or services, except those necessary for the loan application.

Withdrawal from the contract:

The borrower does not have the right to withdraw from the contract within 14 calendar days from the date of its conclusion, since the obligations under it are secured by a notarized mortgage agreement for the real estate object.

You can find information about participating banks, about banks – authorized entities with which PJSC “UKRFINZHYTLO” has concluded a General Agreement on the terms and requirements of cooperation under the state mortgage program yeOselia, lending terms and requirements at the following links:

- Oschadbank: State program yeOselia✔️Terms of yeOselia loan from Oschadbank

- Ukrgasbank: State mortgage lending program “yeOselia”

- PrivatBank: Preferential mortgage for an apartment at 3%, 7% in Ukraine | yeOselia | Housing loan

- Sense bank: yeOSELIA. FEATURES – Individuals

- SkyBank: Mortgage lending yeOselia | SkyBank

- Bisbank: State mortgage yeOselia – BISBANK

- GLOBUS: yeOselia state program – for individuals | Globus Bank is a profitable commercial bank

- RADABANK: Affordable housing lending under the yeOselia program from RADABANK

- BANK CREDIT DNIPRO: State mortgage lending program | yeOselia

- TASKOMBANK: State housing purchase yeOselia program

In accordance with the requirements of the yeOselia program (clause 21 of the Resolution of the Cabinet of Ministers of Ukraine dated 02.08.2022 No. 856), authorized entities of the yeOselia state program may assign the formed loan portfolio to PJSC “UKRFINZHYTLO”.

The transaction on the assignment of the right of claim under loan agreements, mortgage agreements and surety agreements is subject to notarial certification. Information about such assignment is subject to state registration in accordance with the procedure established by law.

In the event of assignment of mortgage loans to PJSC “UKRFINZHYTLO”, the Bank-Authorized Entity shall inform the Borrower and the guarantor(s) (including property guarantors) in writing regarding:

– assignment of claims under mortgage loans (loan agreements/mortgage loan agreements, mortgage agreements/mortgage agreements, surety agreements),

– the need to fulfill all obligations under mortgage loan agreements in favor of PJSC “UKRFINZHYTLO”

– new payment details for further fulfillment of obligations (the procedure for their fulfillment does not change).

– the need to change the beneficiary under each insurance contract in favor of PJSC “UKRFINZHYTLO” (including informing the insurance company about such a replacement).

At the same time, operational and information and consulting services regarding the Borrower’s fulfillment of the terms of mortgage loan agreements (including, but not exclusively, accepting payments, providing the client with and receiving from him certificates/statements/insurance contracts under the loan agreement) are provided by the Bank-authorized entity, which has concluded an agency agreement with PJSC “UKRFINZHYTLO” on the support of mortgage loans purchased by PJSC “UKRFINZHYTLO”.

Banks-authorized entities that service the Company’s mortgage loans:

– ensure compliance with the requirements of the law regarding the inclusiveness of the provision of services;

– post information on their own website regarding the list of third parties that have the right to provide additional and related services in the lending process (including, in particular, insurance, appraisals, etc.).

In case of non-compliance by banks-authorized entities with the conditions of consumer protection, Borrowers whose loans were assigned by banks-authorized entities to PJSC “Ukrfinzhytlo” have the right to contact:

– the body that carries out state regulation of financial services markets and has the authority to protect the rights of consumers of financial services – National Bank of Ukraine -01601, Kyiv, 9 Instytutska St., nbu@bank.gov.ua, tel. 0 800 505 240, (044) 279 12 70

– PJSC “UKRFINZHYTLO” – 9 Kovnira Stepana St., building 5, Kyiv, Ukraine, 01011, info@ukrfinzhytlo.in.ua, +380 (44) 344 09 30

List of banks – authorized entities that have made/are making assignment of loan agreements in favor of PJSC “UKRFINZHYTLO”:

- SkyBank: Mortgage lending yeOselia | SkyBank

- Bisbank: State mortgage yeOselia – BISBANK

- RADABANK: Affordable housing lending under the yeOselia program from RADABANK

- BANK CREDIT DNIPRO: State mortgage lending program | yeOselia

- Globus Bank: yeOselia | state program – for individuals

- Ukrgasbank: State mortgage lending program “уeOselya”

In the chatbot you can find out all the information about the program and ask questions